The Great Advertising Platform Showdown 2024-2025

Who's Winning the Digital Ad Wars? Complete Analysis of Meta, Google, Microsoft, Snapchat, and Pinterest

Total Market Size

Comprehensive Analysis

Meta's Expansion

Pinterest Advantage

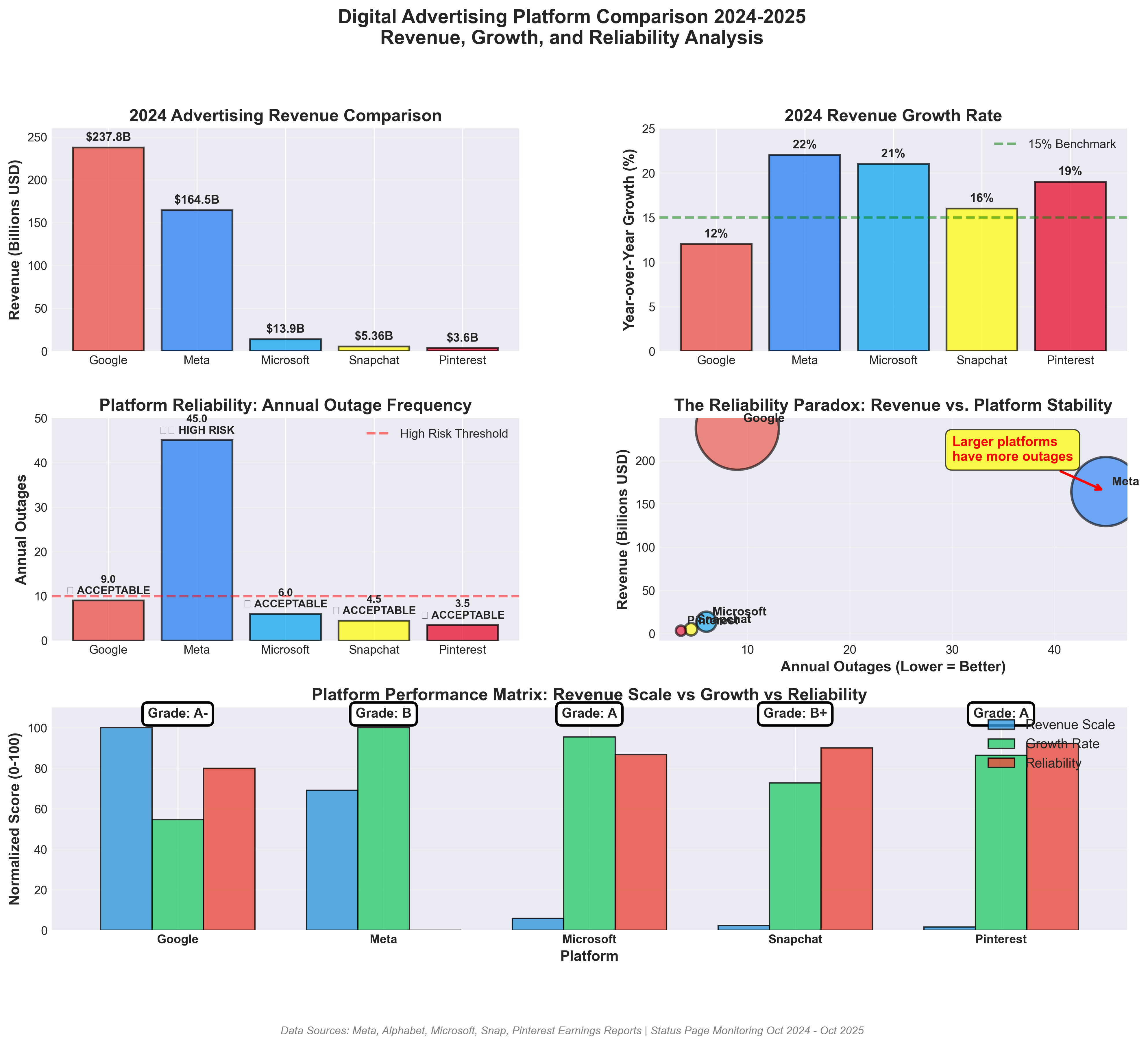

Comprehensive platform comparison showing revenue, growth rates, reliability scores, and overall performance grades

Executive Summary

Key Finding: The digital advertising landscape is experiencing unprecedented growth, with smaller platforms showing exceptional revenue momentum while established giants maintain market dominance.

Platform Rankings at a Glance

| Platform | 2024 Revenue | YoY Growth | Market Position | Overall Grade |

|---|---|---|---|---|

| Google Ads | $237.8B | 12% | Market Leader | A |

| Meta | $164.5B | 22% | Fastest Growth | A- |

| Microsoft | $13.9B | 21% | Rising Star | A |

| Snapchat | $5.36B | 16% | Youth Leader | B+ |

| $3.6B | 19% | ROI Champion | A |

Google Ads

A-The Reliable Workhorse: Market Dominance Through Stability

$237.8B

Largest Ad Platform12% Growth

Consistent Performance2:1 ROAS

Average ReturnMarket Leadership

Google Ads generated $237.8 billion in 2024, maintaining its position as the world's largest advertising platform. With consistent 12% YoY growth, Google's scale and comprehensive ad network make it the foundation of most digital advertising strategies.

Performance Metrics

- Average ROAS: $2 per $1 spent

- Average conversion rate: 6.96%

- Search market share: 91% globally

2025 Performance (Q3)

- Total Ad Revenue: $74.18B (up from $65.85B YoY)

- Search & Other: $56.57B (14% increase)

- YouTube Ads: $10.26B (15% increase)

Platform Advantages

- Unmatched search intent targeting

- Superior reliability with formal SLA agreements

- Comprehensive network (Search, Display, YouTube, Shopping)

- Transparent reporting and attribution

- Integration with Google Analytics

Best For

- Lead generation businesses (B2B and B2C)

- Local service businesses

- E-commerce with Shopping campaigns

- Advertisers requiring guaranteed uptime

- Companies needing detailed attribution

Expert Verdict

Market Position Grade: A+

Revenue Growth Grade: B+

Recommendation: Should form the foundation (35-45%) of most digital advertising strategies. Essential for intent-based marketing and comprehensive reach.

Microsoft Advertising

AThe Underdog Delivering: Consistent Excellence

$13.9B

FY 2025 Revenue21% Growth

Matching Meta!LinkedIn Integration

B2B PowerhouseWhy Microsoft Is Winning

Microsoft Advertising achieved $13.9 billion in revenue for fiscal 2025, posting an impressive 21% YoY growth—matching Meta's growth rate despite operating at 1/10th the scale.

🚀 AI Integration Leadership

- Copilot integrated into Microsoft Ad Platform for natural language campaign creation

- Improved ad relevance through AI-powered targeting

- Better measurement tools for ROI optimization

Audience Quality

- Higher-income users (Bing skews toward professional/enterprise)

- Less saturated market = lower CPCs

- LinkedIn integration for B2B targeting

- Edge browser growth increasing reach

Best For

- B2B advertisers seeking professional audiences

- Businesses wanting lower competition/costs

- Enterprise targeting via LinkedIn integration

- Advertisers seeking Google Ads alternative

Expert Verdict

Innovation Grade: A+

Revenue Growth Grade: A

Recommendation: Most underrated platform. Allocate 10-15% for cost efficiency and B2B targeting.

Snapchat Ads

B+The Youth Marketing Powerhouse

$5.36B

2024 Revenue477M DAU

Daily Active Users16% Growth

Solid MomentumPerformance Highlights

Snapchat achieved $5.36 billion in revenue for 2024, representing 16% YoY growth, driven primarily by direct response advertising improvements.

- Active advertisers more than doubled in Q4 2024

- SMB advertising in North America growing 25%+

- Snapchat Plus subscription revenue exceeds $750M annual run rate

Unique Value Proposition

- Dominant among Gen Z and Millennials

- High engagement (30+ minutes daily average)

- Advanced AR advertising capabilities

- Perplexity AI integration ($400M deal)

Best For

- Brands targeting Gen Z and younger Millennials (under 35)

- Fashion, beauty, entertainment, and lifestyle brands

- AR-enhanced product experiences

- Mobile-first campaigns

⚠️ Emerging Challenges

- Q4 2025 outlook shows potential user decline

- Platform-level age verification impacts

- New minimum age regulations affecting reach

Expert Verdict

Audience Quality Grade: A

Revenue Growth Grade: B+

Recommendation: Essential for youth-focused brands. Allocate 15-20% if targeting under-35 demographic.

Pinterest Ads

AThe Hidden ROI Champion: Quality Over Quantity

$3.6B

2024 Revenue+32% ROAS

Higher Than Competitors19% Growth

Strong Performance🏆 The ROI Winner

Pinterest delivers the highest return on ad spend among all major platforms with 32% higher ROAS than other digital platforms (Nielsen analysis).

Performance Excellence

- Pinterest achieved $3.6 billion in revenue for 2024 (19% YoY growth)

- Q4 2024: First time exceeding $1B in single quarter

- 537M+ monthly active users (11% quarterly growth)

- 30% lower cost per acquisition YoY during holiday shopping

- 80% trend prediction success rate (5 consecutive years)

Why Pinterest Outperforms

- Purchase Intent: 83% of users make purchases based on Pinterest content

- Planning Mindset: Users actively shopping, not passively scrolling

- Visual Discovery: Platform built for product discovery and inspiration

- Audience Quality: Higher household income demographics with purchasing power

Best For

- E-commerce brands (home, fashion, food, beauty)

- Businesses with strong visual products

- Wedding, home improvement, and lifestyle brands

- Advertisers seeking highest ROAS

- Long-term brand building

Expert Verdict

ROI Grade: A+

Revenue Growth Grade: A-

Recommendation: The hidden gem. Allocate 15-25% for e-commerce campaigns. Best ROI among all platforms.

Strategic Budget Allocation Framework

For Most Advertisers (Balanced Approach)

- Google Ads: 35-40% (foundation for intent-based conversions)

- Meta: 25-30% (reach and social engagement)

- Pinterest OR Snapchat: 15-20% (demographic-specific or ROI focus)

- Microsoft: 10-15% (B2B or cost efficiency)

For E-commerce Brands

- Google Shopping: 30%

- Pinterest: 25% (highest ROAS)

- Meta: 25% (Instagram shopping)

- Microsoft: 10%

- Snapchat: 10% (if targeting under-35)

For B2B Companies

- Google Search: 40%

- Microsoft/LinkedIn: 30%

- Meta: 20%

- YouTube: 10%

2025 Strategic Action Plan

Immediate Actions (This Quarter)

- Audit Current Allocation - Calculate platform dependency percentage and identify risks

- Diversify Risk - Cap Meta allocation at 50%, add 2+ additional platforms

- Implement Monitoring - Set up real-time campaign alerts and status updates

Medium-Term Strategy (2-3 Quarters)

- Optimize by Platform Strength - Align each platform with its core competency

- Build Platform Expertise - Train teams on multiple platforms

- Leverage AI Tools - Test Meta Advantage+, Google Performance Max, Microsoft Copilot

Long-Term Evolution (12+ Months)

- Reduce Platform Dependency - Invest in owned channels (email, SMS)

- Stay Agile - Monitor reliability trends quarterly and adjust budgets

The Golden Rules of Platform Selection

- Never allocate more than 50% to a single platform (diversification insurance)

- Reliability matters more than reach for time-sensitive campaigns

- Test smaller platforms (Pinterest, Microsoft) for efficiency gains

- Monitor, don't set and forget (monthly reviews minimum)

- Build backup infrastructure (assume outages will happen)

The Verdict: No Single Winner

🏆 Overall Best Platform

Google Ads

Balance of scale, reliability, and performance. Foundation for most advertising strategies.

A-🚀 Fastest Growing

Meta

Despite reliability issues, revenue growth is undeniable. AI tools driving adoption.

B💎 Most Reliable

Best uptime, highest ROAS, consistent performance. Limited by smaller scale.

A💰 Best Value

Microsoft

Exceptional growth, low costs, high reliability. Underutilized by most advertisers.

ALooking Forward: The 2025 Landscape

The digital advertising landscape is at an inflection point. Meta's reliability crisis, Google's maturation, and the rise of alternative platforms signal a shift from "platform concentration" to "strategic diversification."

Winning Advertisers in 2025 Will:

- Spread risk across multiple platforms

- Prioritize reliability alongside reach

- Leverage AI tools where proven effective

- Maintain agility to shift budgets quickly

- Build owned channel alternatives

The $500+ billion digital advertising market is no longer a two-platform game. Smart advertisers will embrace the full ecosystem, reducing risk while maximizing returns.

Methodology & Data Sources

This analysis synthesizes:

- Official earnings reports (Meta, Alphabet, Microsoft, Snap, Pinterest)

- Public platform status pages (metastatus.com, Google Status Dashboard)

- Industry research (Nielsen, eMarketer, Statista)

- Advertiser performance data

- Platform reliability monitoring (Oct 2024 - Oct 2025)

Analysis Period: October 2024 - November 2025

Last Updated: November 12, 2025

Never Miss an Ad Platform Outage Again

Get instant Slack notifications when Meta, Google, or Microsoft advertising platforms go down.

Start Free Trial →